The recent spike in fuel prices may have a few people wondering if they should trade their gas guzzlers for an electric car. Fuel economy certainly isn’t a new issue for American drivers. Back in 1978, the government created the “Gas Guzzler Tax” to incentivize the purchase of more fuel-efficient cars. Whether it worked is a matter of debate.

Thankfully, classic cars are not impacted by the Gas Guzzler Tax. This tax only applies to new passenger cars that do not meet the EPA’s gas mileage threshold. What is that threshold? Currently, it’s set at a combined city/highway mileage of 22.5mpg. But here’s where it gets complicated. The EPA doesn’t measure the fuel economy of new cars by anything as simple as filling the tank, driving the car around, and watching the tank empty. They measure emissions on a “rolling road” dyno, then apply all sorts of mathematical calculations to account for everything from aerodynamic drag to air quality.

Traditionally, those numbers yield a miles-per-gallon figure that is considerably more than what real-world drivers experience. Remember the ads for the Plymouth Horizon/Dodge Omni “Miser” and its 50mpg highway rating? There’s a correction factor applied to give you the numbers on your window sticker. In 2008, the EPA added three additional tests for mileage calculation: higher speeds, air conditioner use, and colder test temperatures. But the Gas Guzzler Tax, like the Corporate Average Fuel Economy (CAFE) Tax, is calculated on the EPA number before those adjustments and three additional tests. Which is why you can have a car with a window-sticker mileage figure beneath 22.5mpg that doesn’t pay the tax.

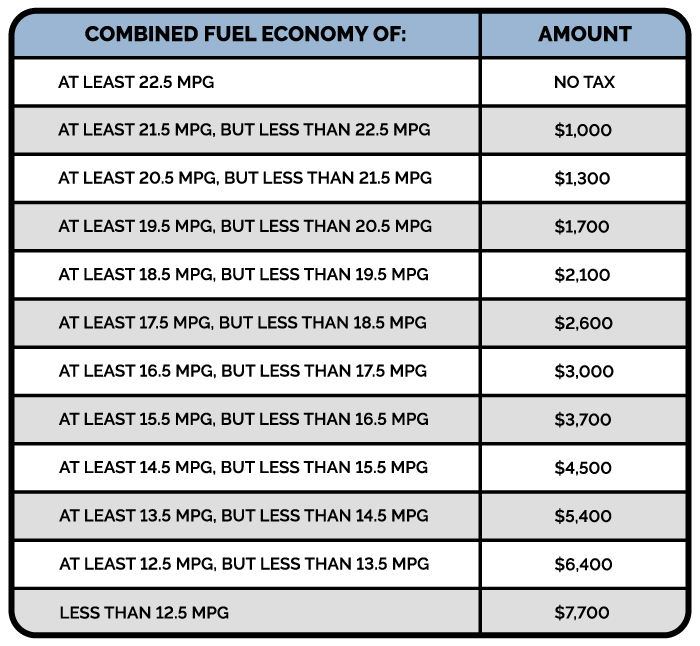

The Gas Guzzler Tax structure works like this:

Obviously these amounts would make a big difference to the price of an everyday driver – but as we will see, they’re almost never applied to the best-selling cars and trucks.

The average passenger car today is at no risk of the Gas Guzzler Tax, and hasn’t been for decades. In 1976, the best-selling cars in America were the Oldsmobile Cutlass, Chevrolet Impala/Caprice, and Chevrolet Monte Carlo. Most of them were sold with at least a 350ci V8, and in many cases they left showrooms with a 403ci V8. The real-world economy of those cars was usually between 8-12mpg. Today’s equivalent best-selling car, the Honda Accord, manages 30-35mpg under these same conditions.

Just as importantly, the Gas Guzzler Tax doesn’t impact pickup trucks or SUVs, which weren’t significant factors in the sales charts of 1978, when the law was signed. A Cadillac Escalade or Lincoln Navigator will often return real-world fuel economy figures that wouldn’t surprise a 1976 Caprice owner – but they’re off the hook for the gas guzzler tax. This, along with Corporate Average Fuel Economy regulations that also cut a break to “trucks,” goes a long way to explain why the typical family vehicle now is a 4700-pound sport-utility vehicle that isn’t really much more efficient that the full-sized cars of fifty years ago.

What new cars are affected by the Gas Guzzler Tax?

Someone once wrote that “The EPA’s Gas Guzzler Tax list reads like a dream garage,” and when you look at the Ferraris, Bentleys, and Rolls-Royces on the list, it’s hard to disagree. Even the most desirable Corvette, the flat-crank, high-rpm Z06, falls prey to the penalty, albeit on the lighter side of the scale.

Environmentalists shouldn’t get too upset. Most of these cars tend to be occasional-use vehicles that don’t rack up a lot of miles between visits to the auction house floor.

Similarly, the lower mileage and higher emissions of classic and collector cars don’t have the kind of impact on the environment that some would suggest. Not only are they driven relatively infrequently, they are also a long way away from the environmental costs of their production. A new electric vehicle is much harder on the environment in its first year than a 60-year-old classic car would be.

Having fun while avoiding the Gas Guzzler Tax

Want to enjoy driving without paying the EPA the price of a new motorcycle for the privilege? There are plenty of great new cars for enthusiasts that don’t incur the penalty, from standard-model Corvettes to “hot hatches” like the Volkswagen GTI, all the way to the classic Mazda MX-5 Miata. But you can also choose a classic or collector car which isn’t subject to the tax.

Although classic and collector car values have generally risen in the past few years, there are still plenty of bargains out there – and when you consider the fact that you won’t pay any additional taxes for buying them, the argument for being a classic or collector car owner is even better!