Home | Agents | Collectors Insurance Products | Collectibles Insurance

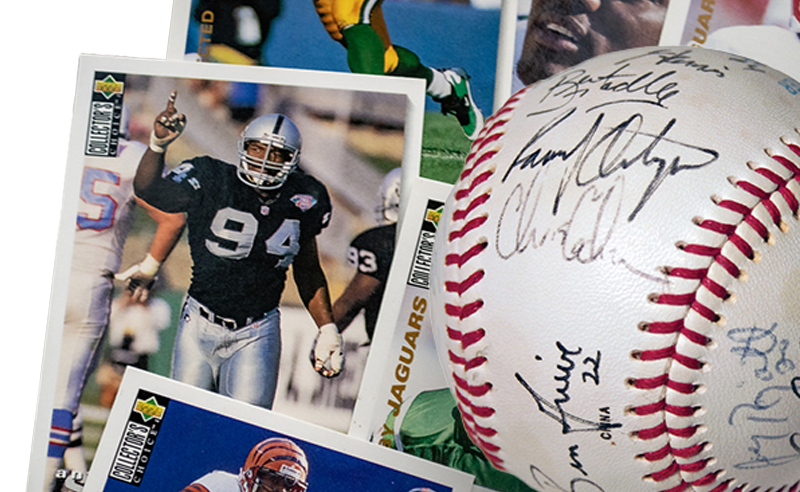

Collectibles Insurance

Our collectibles policies differ from standard homeowners insurance by offering broader collectibles coverage and Agreed Value coverage. Learn about the coverage benefits that were built to protect a broad range of special collections.

Collections often grow in value, worth more than the collector imagines. Many collectors don’t realize relying on homeowners insurance to cover loss or damage could leave them sadly disappointed. This is your opportunity to help educate and protect. Insure your clients’ treasured collections today!

Accidents happen. Homeowners insurance will not cover accidental breakage or damage or loss due to natural disasters such as flood and earthquake (see chart to compare).

The features of our collectibles policy ensure that your clients’ treasured collections will be covered for the most common types of damage.

Policy Features

Agreed Value Coverage

Qualifying collections are insured for their full collector value less any deductible, and never depreciate. Coverage also applies to accessories such as model train layouts, and product packaging.

Broader Coverage

Includes damage caused by accidental breakage, fire, flood, theft, hurricane, earthquake, and more.

Collector’s Choice Plan

Ideal for collectors who desire additional coverage for damage that occurs:

- During the shipment of newly purchased items

- While repairing, restoring or retouching an item (up to $2,000)

- While an item is being handled or worked on (up to $2,000)

- To property stored or displayed outside the residence for more than 30 days

- Due to theft from an unattended vehicle

- Coverage also includes Special Occasion Usage of fragile collectibles such as glass, ceramic, crystal, porcelain, stoneware and other fragile collectibles

Inflation Guard

For scheduled items automatically increases items valued over $2,000 by 2% quarterly, up to 8% annually, at no additional cost.

Automatic Coverage for New Additions

The collectibles policy provides automatic coverage for newly acquired pieces for 30 days up to a maximum value of $2,000.

Qualifying Collectibles

All qualifying personal collections in a household may be covered on the same policy. Below is a partial list of qualifying collectibles and manufacturers, including newly eligible collections. If a collection doesn’t appear on this list, please call us toll-free to speak with a licensed product specialist.

Eligible Collections:

- Books & Maps

- Coins & Bullion

- Collectible Dinnerware/Stemware

- Collector Quilts

- Comic Books

- Guns

- Prints

- Stamps

- Trading Cards

- Wine

- Action Figures

- Advertising Materials

- Animation

- Automobilia

- Collector Plates

- Die Cast

- Dolls

- Figurines

- Jukeboxes

- Militaria

- Model Trains & Sets

- Ornaments

- Pottery

- Sports Memorabilia

- Teddy Bears

- Villages

Submission Requirements

It takes just a few minutes to quote and submit your next risk online! Once approved, you will receive a confirmation email listing premium payment options.

Please Note: American Collectors Insurance does require the total annual premium in order to bind coverage, and photo(s) and forms must be received within 20-days. Upon receipt of the premium payment, temporary ID cards will be made available via email. We will review & respond within 24 hours to risks that are not immediately accepted. It’s that easy!