Collector Auto Insurance for Custom Classic Cars

Your showpiece isn’t just a mode of transportation— it’s a reflection of your individuality. Our modified car insurance coverage is designed to provide the perfect level of protection for your one-of-a-kind vehicle.

- Tailored Agreed Value policies

- Knowledgeable passionate specialists

- Flexible mileage options that align with unique events & driving habits

Get a Quick Quote

"*" indicates required fields

What is Classified as a Modified Vehicle?

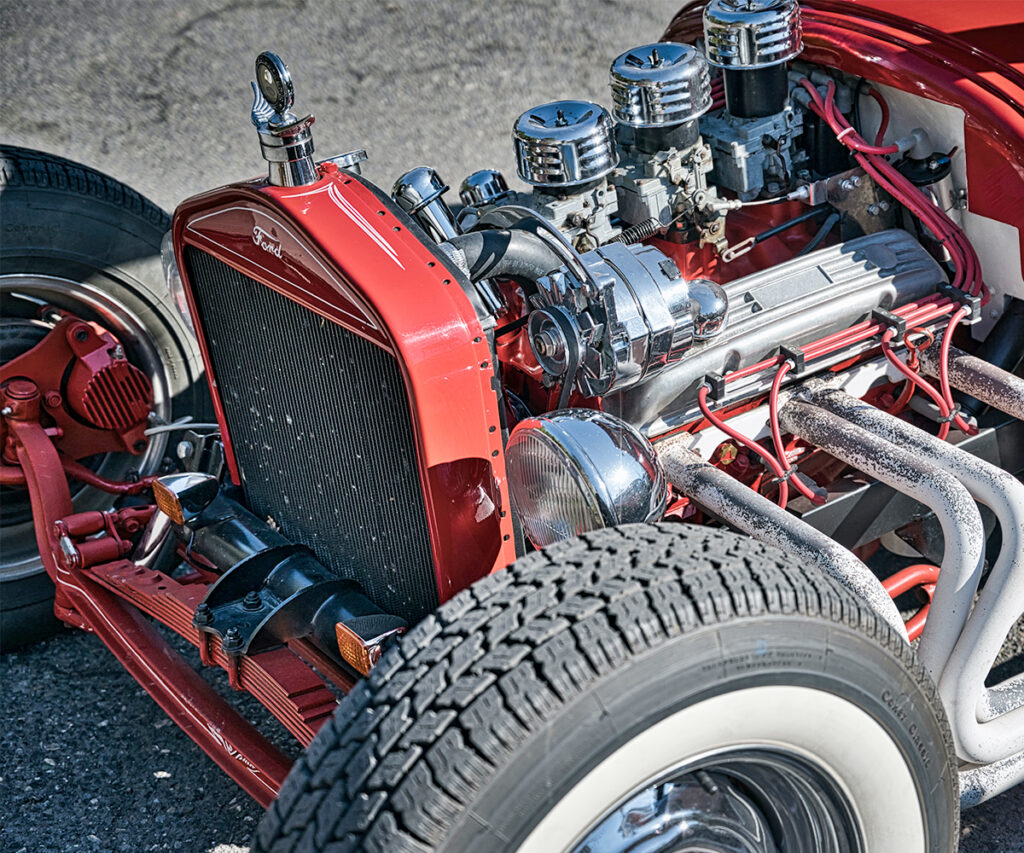

Modified vehicles undergo alterations beyond original factory specifications. These alterations can include installing aftermarket parts, making upgrades, adding various add-ons, or incorporating custom modifications.

To ensure proper protection, modified vehicles often require additional coverage tailored to their unique features and enhancements.

Our Modified Car Insurance Covers:

Classic Muscle, Hot Rod, & Modified Car Insurance Features

Enjoy your ride and have peace of mind with broader coverage to protect your collector vehicle.

Agreed Value Coverage

With Agreed Value coverage, you can always be certain how much you will receive if a “total loss” occurs.

Most Flexible Mileage

Our flexible mileage plans give you flexibility to customize your classic car insurance policy to match how much you actually drive your collector vehicle.

Discounts Available

We have a wide range of discounts available, such as: high-value vehicles ($250K+), multi-vehicle policies, mature drivers, garage security, winter lay-up, car club membership, anti-theft features, or even storage on a vehicle lift.

Coverage for Vehicles in Restoration

We’ll protect your collector car throughout the duration of an active restoration.

Inflation Guard

In the event of a covered total loss to your collector car, inflation guard automatically adjusts the Agreed Value limit for your vehicle(s) during the policy term (up to a maximum of 6%/year).

Spare Parts Coverage

Get up to $500 for loss or damages to your classic “spare parts” or automotive tools that you own and are used for the maintenance of your collector car.

Automatic Coverage for Newly Acquired Vehicles

We offer up to 30 days of automatic coverage for qualified collector vehicles that you purchase during your policy term (up to $100,000).

Multi-Vehicle Discount

Discounts are available to collectors with multiple qualifying vehicles, including hot rods, muscle cars and more.

See if you meet a few simple requirements

Get A Collectors Insurance Quote In Just Minutes

Underwriting Policies For Hot Rod, Custom, & Modified Cars Insurance

At American Collectors Insurance, our underwriting policies reflect our commitment to delivering tailored coverage for modified vehicles. Our experienced underwriting team meticulously assesses each policy to ensure it aligns with your car’s unique vehicle modifications and specifications.

- Personalized Assessment: Our underwriters analyze your car’s modifications to craft a policy that suits its distinct features.

- Agreed Value Coverage: We provide coverage based on the agreed-upon value of your vehicle, eliminating depreciation concerns.

- Expert Knowledge: Our underwriters specialize in assessing modified cars, guaranteeing accurate and comprehensive coverage.

American Collector’s Insurance Reviews

See why our customers trust their collectibles with American Collectors Insurance.

Frequently Asked Questions

Do I Qualify for Custom Car and Hot Rod Insurance?

We will consider drivers with:

- At least 5 years of licensed driving experience.

- Clean driving record. No more than one moving violation or one at-fault accident within the last 3 years (up to 2 per household). DUI’s and reckless driving violations must be at least 10 years old.

- One regular-use vehicle for every licensed driver in the household (exceptions may be made for full-time students and retired couples).

Does My Car Qualify?

We will consider any vehicle that has collector merit and is appreciating in value. However, we also require that they are:

- Driven on a limited basis and not used for daily driving.

- Not used for racing, timed events or driver’s education.

- In good condition (vehicle is restored, preserved, upgraded, or in the process of restoration)

- Stored in an enclosed, locked garage (alternate garaging options may be permitted; contact our representative).

Can you get insurance on a custom car?

Absolutely, you can obtain insurance coverage for your custom car. Many insurance companies offer specialized policies, often referred to as custom car insurance or customized vehicle insurance, to cater to the unique features and modifications of your vehicle. These policies ensure that your investment is protected, and any alterations you’ve made are accounted for in the coverage.

Are custom cars more expensive to insure?

The cost of insuring a custom car can vary based on several factors. While customization itself doesn’t necessarily guarantee higher premiums, factors such as the value of your car and the extent of modifications can influence your car insurance rates. Some modifications might lead to increased premiums due to the potential for higher repair costs, but this depends on the specific modifications and the insurance company’s underwriting policies.

Do you have to tell insurance about car mods?

Yes, it’s crucial to inform your insurance company about any car modifications. Failing to disclose modifications can lead to coverage gaps or claim denials. By providing accurate information about your car’s modifications, you ensure that your policy, including collision coverage and equipment coverage, accurately reflects the value of your car and the modifications you’ve made.

Does a body kit affect insurance?

Yes, adding a body kit to your car can potentially affect your insurance coverage and rates. Body kits can alter the appearance and value of your vehicle, which can impact the cost of repairs in case of an accident. It’s recommended to inform your insurance company about the installation of a body kit to ensure that your customized car is adequately covered under your policy.

Does modding your car make the insurance go up?

Modifying your car can impact your insurance rates, but it’s not a one-size-fits-all scenario. Some modifications might lead to higher rates due to increased repair costs, while others could potentially enhance safety features and result in lower rates. It’s essential to discuss the specifics of your car modifications with your insurance company to understand how they might affect your auto insurance rates.

How do you declare modifications?

When declaring modifications to your insurance company, start by providing a detailed list of the alterations you’ve made to your vehicle. This list should include both performance and aesthetic modifications. You may also need to provide documentation, such as receipts, invoices, or photographs, to validate the changes.

By openly discussing these modifications with your insurance company, you ensure that your policy accurately reflects the value of your customized car and that you have the appropriate coverage in place.