Collectibles Insurance

At American Collectors Insurance, we’re passionate collectors who care about the value of your collectibles. Our collectibles policies differ from standard homeowners insurance by offering broader collectibles coverage and Agreed Value coverage. Learn about the coverage benefits that were built to protect special collections like yours.

- Tailored Agreed Value policies

- Knowledgeable passionate specialists

- Protections against inflation

Get a Quick Quote

"*" indicates required fields

Collectibles Insurance Policy Features

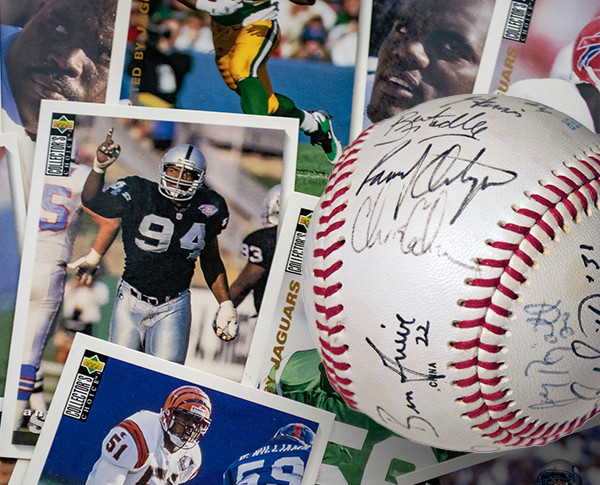

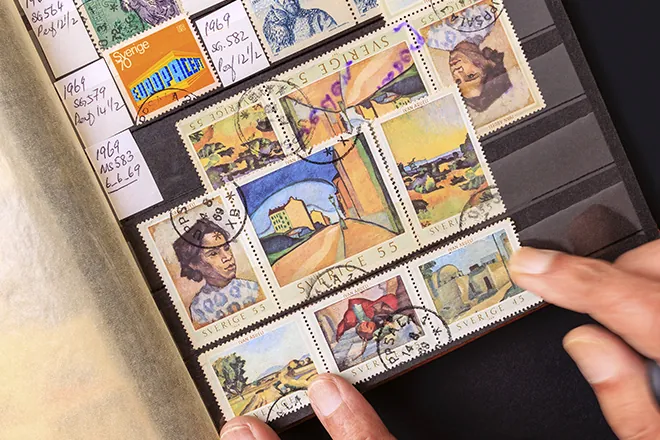

We offer comprehensive protection, recognizing the historical and intrinsic value of your items, be they classic, vintage, or unique. Whether it’s stamps, coins, comic books, toys, or sports memorabilia, we ensure your collectibles are fully secure.

Agreed Value Coverage

Qualifying collections are insured for their full collector value up to the policy limits, pending valuation by our collector insurance specialists.

Broader Coverage

Unlike standard homeowners policies, protect your collectibles against accidental breakage, fire, theft, and natural disasters.

Mysterious Disappearance

Coverage is provided for mysterious disappearance for items that are worth $2,000 and scheduled on the policy.

Inflation Guard Protection

In the event of a covered total loss of your collection, Inflation Guard adjusts the Agreed Value of the covered items up to 6% max.

Unmatched Personal Service

Our reps are friendly, prompt, knowledgeable, honest and dedicated to making the claim process as smooth as possible.

Automatic Coverage of New Additions

Expanding your collection? We’ll automatically cover new purchases to your collection up to $2,000. Just tell us within 30 days.

Collector’s Choice

The Collector’s Choice enhancement protects items being shipped, stored outside of residence, or used for special occasions.

Program Features and Availability Vary by State

Exceptions do apply. Currently, we do not cover furniture, fine art, or jewelry. Contact us for more details.

Special Policy Enhancements

Collector’s Choice policy enhancements include special coverage for collectibles you use.

See if you meet a few simple requirements

Get A Collectors Insurance Quote In Just Minutes

Insurance For Collectibles

Our comprehensive collectible insurance covers a range of collections. We cover wine collections, valuable stamps, comic books, vintage toys, sports memorabilia and more. Our tailored policies cater — the distinct characteristics and value of each collectible, ensuring their protection. From safeguarding cash value to addressing exclusions or sublimits, our coverage extends to collections of all kinds.

American Collector’s Insurance Reviews

See why our customers trust their collectibles with American Collectors Insurance.

Frequently Asked Questions

Can you get insurance on collectibles?

Yes, you can obtain insurance for collectibles. Collectible insurance is a specialized form of coverage designed to protect valuable items like artwork, coins, trading cards, and other prized possessions against damage, theft, or loss.

What is collectible insurance?

Collectible insurance is a type of coverage tailored to safeguard valuable items such as art, antiques, musical instruments, and more. It offers financial protection against potential risks, ensuring that the collectible’s full value is compensated in case of damage, theft, or loss.

Is collectors insurance expensive?

The cost of collectors’ insurance varies based on factors like the type and value of your collectible items, coverage limits, deductibles, and other considerations. While premiums can vary, many collectors find that the expense is reasonable in exchange for the peace of mind and full-value coverage it provides.

How do I insure my collection?

To insure your collection, you’ll need to contact an insurance provider that offers coverage for collectibles. You’ll typically need to provide a detailed inventory of your items, including their estimated value. An insurance adjuster may assess your collection to determine its worth and recommend suitable coverage options.

At what point should you insure a collection?

It’s advisable to insure your collection as soon as its total value becomes significant to you. Whether your collection comprises artwork, coins, or musical instruments, protecting it with insurance offers peace of mind against potential risks such as theft, damage, or loss.

What is private collections insurance?

Private collections insurance is a specialized coverage designed for individuals who possess valuable collectible items like art, antiques, and other high-value possessions. This coverage often provides broader protection than standard personal property insurance, accounting for the unique needs of collectors and their valuable items.

Do collections ruin your credit?

No, collections insurance itself does not impact your credit. Insurance services for collectibles are unrelated to your credit history. Instead, they focus on providing protection for your valuable items, ensuring you’re financially covered against potential risks or losses.

What do collectibles insurance policies cover?

Collectibles insurance covers collections such as rare stamps, valuable coins, wine collections, sports memorabilia such as vintage baseball cards, vintage toys, comic books, and more. Collectibles insurance protects your collection against theft, accidental breakage, flooding and more. Unlike other insurance policies, our insurance covers your collection with Agreed Value insurance coverage. With an Agreed Value policy you know exactly what your collection is insured for at the time of the loss.* This way, we create the right policy to protect your collection from:

- Theft

- Fires

- Floods

- Natural Disasters

*Wine, Stamps and Coin losses are settled based on Fair Market value unless the items are scheduled, in which case the scheduled items are covered for Agreed Value.